We’re proud to announce TurnKey Lender v.7.11. The first release of the year is a major platform update focused on our Platform’s international and generative AI capabilities.

The key regional edition updates are aimed at the USA, United Kingdom, New Zealand, and Australia. For each, we’ve made strides in localizing decisioning, origination, and regulatory compliance readiness.

The bulk of changes consists of new and improved integrations that make it easier than ever to make accurate loan decisions backed by targeted borrower data, manage payments, e-signatures, and more.

Even though it’s a mostly international release of our platform, let’s start with our even bigger passion – AI in credit.

The AI Assistant – Generative Artificial Intelligence in loan negotiations and collections

The Generative AI update introduces new loan origination and debt collection tools that simplify communication for lenders and borrowers. It builds on a range of TurnKey Lender’s existing AI applications in credit scoring, decision-making, and collections and weaves in Models into credit.

Borrowers interact directly with the built-in language processing models through the AI Assistant. It negotiates loan terms, personalises the loan collection process, and helps understand the loan agreement details.

We will be gradually adding the AI Assistant to other parts of our Platform with each release.

Loan agreement interpretation

Understanding the loan agreement might at times be tricky, and this is exactly where AI-based conversation can be particularly useful.

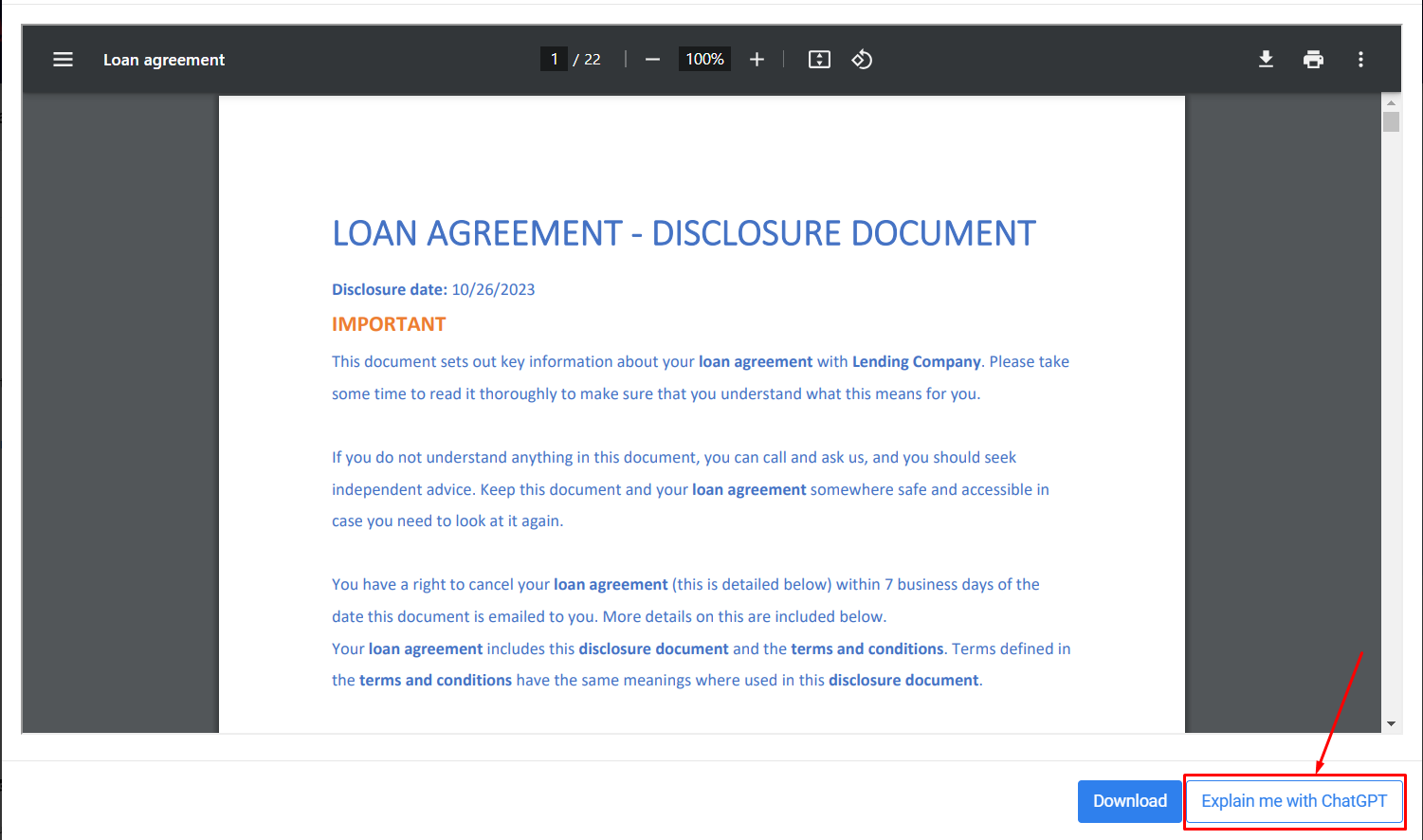

Once the Borrower has opened their agreement in the Borrower’s portal, they can view the agreement. If they have any questions, there is an “Explain with AI Assistant” button.

The system will read through the document and provide the list of main agreement points.

In the chat below it, the Borrower can ask specific questions about the Agreement.

Here’s an example of such a chat.

Using AI for communications

Streamlining borrower communications has always been our focus for the TurnKey Lender Platform. This includes the ability to add customized email and SMS templates and other capabilities of the contact tab. A new way to generate an email to the customer includes the use of AI (ChatGPT) capabilities.

The feature has to be turned on in the configuration, and the list of available message types depends on the specific account settings.

TurnKey Lender provides an easy-to-use but rather extensive collection of settings with which you can create a message that will dynamically use information about the specific loan and customer and follow the tone and needs you’ve specified.

- TurnKey Lender merge fields are used as message data points that are dynamically added to the email.

- Tone of the messages can be defined. Set it to any tone from “Friendly” to “Final” or go on with the default tone, which is automatically chosen based on the current state of the loan and past dues.

- “Make email urgent” setting will reprocess the text so that no one has any doubt on the need to act ASAP.

- Along or even instead of the setting, you can ass a Custom Prompt. For example, you can set the most friendly tone and high level of detalisation, but add a prompt like “According to legal regulation 234 you are obliged to make the payment on time”. While basic settings will be followed, the message will stay rather official.

Both these features are especially useful the most for large-scale financial institutions and consumer finance providers where it leads to less carts’ abandonment and increased customer lifetime value, not to mention the saved time and effort for the staff.

TurnKey Lender US edition updates

Making better use of Plaid data at a better price

To offer more balance between cost and functionality, our Decision Engine has learned to extract more meaningful data from statement information available in a lower-tier Plaid subscription.

While in-depth credit scoring requires full Assets and Transactions Plaid reports, TurnKey Lender Decision rules will still work effectively even if your Plaid subscription only includes basic borrower details.

Support for a new Equifax product – Pre-Approval of One™

This product allows for credit application initiation without impacting the credit score. A hard inquiry is only made if the consumer accepts the pre-approved offer, enhancing consumer experience while maintaining rigorous evaluation. Lenders who use Equifax’ new Pre-Approval of One™ product, can now take full advantage from it in their TurnKey Lender Platform.

Enhanced Clarity integration for better credit data interpretation

- We’ve improved the way TurnKey Lender interprets and explains Clarity CB responses. Now the descriptions of Clarity responses are understandable for the user both in the integration settings and when analysing borrower data. Integration improvements ensure clear understanding of credit bureau responses, especially in cases of negative feedback.

- Clear Advanced Attributes™ & Clear Bureau Lite™ by Clarity are now fully compatible with TurnKey Lender. These new products enhance risk assessment capabilities, providing detailed information to refine credit risk strategies.

Repay tokenization support for more secure payments

Our long-term partners at Repay have implemented a new, more secure way to transfer funds and we’ve added full support for it in TurnKey Lender. This strengthens ACH and card payment security through tokenization, an alternative to encryption. This method replaces sensitive data with unique, non-specific tokens, ensuring enhanced data protection and full payment support for lenders when integrated with Repay.

TurnKey Lender UK Edition updates

Since we’ve rolled out the UK edition of TurnKey Lender, we’ve grown significantly in the Kingdom. For v.7.11, we have updated our UK APIs, import settings, application form and decision rules. Yet, the majority of the improvements are the in-depth integrations with local payment providers, credit bureaus, and others.

Experian UK – New Credit Bureau products support

Delphy Select & Castlight Affordability Passport by Experian are now fully compatible with TurnKey Lender. The integrations provide deeper insights into borrowers’ creditworthiness. Delphy Select offers a comprehensive view of credit history, while Castlight Affordability Passport delivers a detailed affordability assessment, improving application decision accuracy.

TrueLayer Open Banking support

TrueLayer is a global open banking platform that provides financial institutions with the ability to securely access financial data and enable instant payments.

Now, UK lenders can use it for bank verification & statement reports which enables automatic bank data verification and statement retrieval.

An important standout feature here is that bank statement data refreshes without borrower re-login, ensuring continuous data accuracy and efficiency in loan processing without straining the customer.

Bottomline – innovative payment provider Integration

Preconfigured integration with Bottomline, one of the most advanced local payment providers, allows UK lenders to perform disbursements and repayments directly from TurnKey Lender as well as to schedule direct bank transfers.

NoSia/SNoSIA notifications for simplified UK compliance

In the UK, lenders need to send a letter if you fall two or more payments behind on your loan. Now TurnKey Lender incorporates necessary notifications to meet UK regulatory standards, ensuring the lending process adheres to local compliance requirements seamlessly.

These enhancements specific to the UK Edition focus on improving decision-making, transaction efficiency, and regulatory compliance, reinforcing TurnKey Lender’s commitment to providing robust and adaptive solutions in the dynamic financial landscape.

TurnKey Lender updates for Australia and New Zealand

TurnKey Lender Australian edition update

- We have improved the Zepto (Split Pay) integration in the Australian edition. It enables direct disbursement to vendors via Zepto, streamlining payment processes.

- Integration with Illion Bank verification allows skipping Zepto payment agreement signing under certain conditions.

- And the extended Illion Bank Provider integration incorporates Illion’s Transaction Risk Score (ITRS) into decision rules, offering a more nuanced risk assessment for lending decisions.

New Zealand Illion integrations

To serve our New Zealand customers better, we’ve introduced iIllion Credit Bureau & Bank Verifications integrations. This enhances credit and bank verification processes, integrating Illion’s services into the loan processing flow, bolstering decision-making accuracy.

Mentioned Users Added to the Loan Comments History

Yet another feature that enhances the accountability of the users in the system is a new “Comments” tab improvement.

As you know, when adding a comment to the loan, it is possible to Add a user notification.

For example, we have mentioned two users with the “Write-off approval” permission asking to consider the write-off.

After such a message is sent, “Mentioned users” details will be available.

More platform updates

With v.7.11 we’re rolling out improved payments management, expanded borrower document access, refined credit product calculations, strengthened DocuSign integration, and more. Here are the features lenders and borrowers will have access to.

- Payments management flexibility. We are constantly working on making the system more user-friendly and reducing the load of manual work. With this release we have added some more defaults and removed some of the limitations, so now:

- It is easier to define holiday calendars

- It is possible to suspend last scheduled transaction

- It is possible to enable notifications for imported loans

- When creating a credit product, lenders can now assign users who can define the equal payment amount for loans. Company policies may allow or not allow multiple users to change the equal payment, this feature gives you full control over who gets access to this option.

- Provided borrowers with the ability to view and download system documents. The “System documents” section is now available in the Borrower’s Portal.

- New and updated credit product calculations – we’ve enhanced Rule 78 accuracy with the “365 days, 52 weeks” option, added more Equal Payment and Suspended Transactions controls.

- Improved DocuSign integration includes OAuth Authentication. Recommended by DocuSign for enhanced security and integrity, now supported in TurnKey Lender.

- Manual transaction reversal is enhanced and the transaction reverse reason is made obligatorily. When a registered transaction is reversed, it is important for all the participants to know the reason for such a change.

That’s all the updates we have for you in TurnKey Lender v.7.11, but we’re already working on the next big platform updates so stay tuned for more or request a demo today!